Frequently Asked Questions

Find below important answers enrollment professionals often have, including price and how to get started with LRAPs on your campus.

How LRAPs Help Colleges & Students

Watch this quick, 2-minute video to learn how LRAPs positively impact enrollment decisions for prospective students and families by removing the fear of student loan debt.

Watch NowFeatured Resources

LRAP Gives Parents Peace of Mind About Student’s Dream School

Blog

4 Proven Ways to Increase Enrollment with LRAPs

Blog

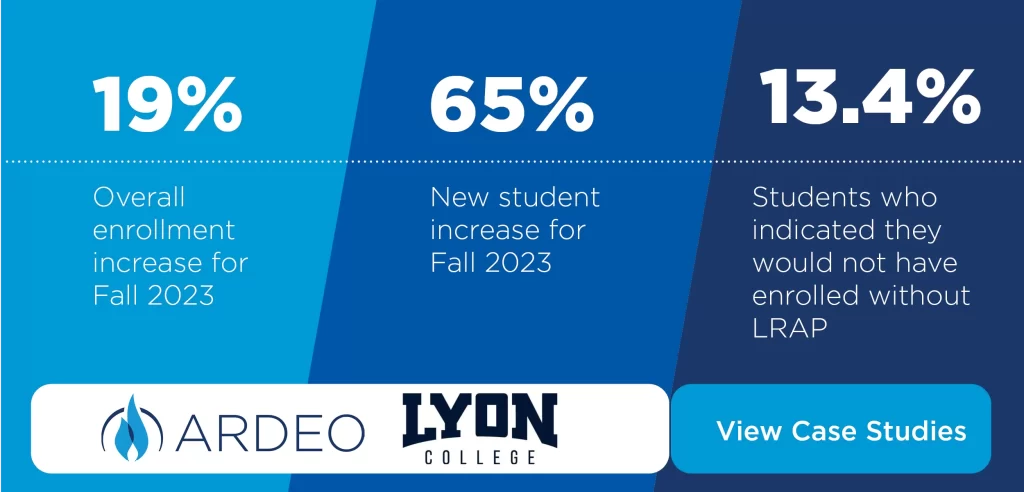

Lyon College Celebrates 19% Enrollment Growth

Blog

Read Our Book

Still have questions? Deep-dive into how Loan Repayment Assistance Programs got their start, different ways colleges and universities use the program to boost enrollment, and the life-changing impact they’ve made on students. Request your free copy of our book here.

Request Demo