Enrollment Success

Key Takeaways

- Nationwide teacher education program enrollment dropped 33% from 2010 to 2018. Completion rates declined 22% from 2012-13 to 2018-19.

- Among other factors, lower starting salaries coupled with the burden of student loan debt make education a less attractive field.

- By removing anxieties about repaying loans in the future, LRAPs enable enrollment in the present (generating an average 5X return for college partners).

In the ever-evolving landscape of higher education, institutions are faced with numerous challenges. Among them, the declining enrollment in teacher education programs and completion rates.

In this blog, we’ll delve into the challenges facing teacher education programs. Plus, we’ll explore how Ardeo’s Loan Repayment Assistance Programs (LRAPs) provide students with the financial peace of mind they need to enroll.

The Crisis in Education

Education programs are facing a staggering drop in enrollment. Once the most popular field for undergraduates, education program enrollment has witnessed a shocking 33% decline from 2010 to 2018.

In addition to other factors, prospective education majors are deterred by infamously lower starting pay coupled with the possible burden of student loan debt. This has made it increasingly difficult, not only to attract future teachers, but to retain them.

In recent years, the completion rates in teacher preparation programs have been on a decline, dropping 22% from 2012-13 to 2018-19. This decline not only affects individual students and institutions but exacerbates a teacher shortage that’s been brewing for at least a decade.

According to the National Center for Education Statistics, nearly 9 in 10 public school districts struggled to find qualified teachers for the 2023-24 academic year. As the demand for teachers outpaces the supply, the education sector faces a serious challenge.

Colleges and universities can’t address all the challenges plaguing the teaching profession – such as too little on-the-job resources or support. However, there is a way for them to help their aspiring teachers get the education they need.

The Security Aspiring Teachers Need

For many aspiring educators, the field’s infamously lower starting salaries are a major barrier to enrollment, especially for students who must borrow. Aspiring educators worry about being unable to repay their loans. This concern is particularly palpable for those from low-income families.

While there are many well-intentioned student loan initiatives seeking to relieve the burden of student loan debt, most programs fall short. Their unfulfilled promises are well-documented, casting a long shadow that forces aspiring teachers to sacrifice their dreams and prioritize institutions they perceive to be less expensive over those that would suit them best.

The Financial Safety Net Making a Difference

Ardeo’s Loan Repayment Assistance Programs (LRAPs) are the financial safety net aspiring educators need to attend your institution.

LRAPs help repay student and parent loans if income after graduation is modest. The program has been trusted by more than 200 colleges and universities thanks to the comprehensive, reliable support it provides.

The program covers any loan certified by the college’s financial aid office including federal student, private alternative, and parent PLUS loans (as well as TEACH Grants that have converted into loans).

College partners and students love Ardeo’s in-house call team, which includes English and Spanish speakers who educate students and families on the program. Our team fields questions and requests from students within one business day on average.

By removing anxieties about repaying loans in the future, LRAPs enable enrollment in the present.

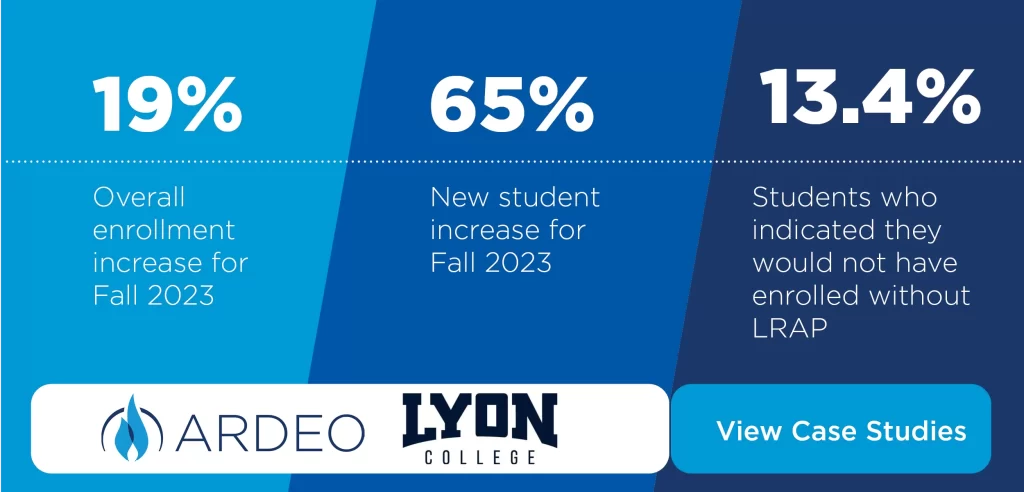

The Real Impact on Institutions and Educators

The impact LRAPs have is not theoretical. The program makes a real and measurable difference in the lives of educators and institutions.

According to surveys, 1 in 3 education majors enrolled with LRAPs agree they would not have attended their institution without the financial peace of mind the program provides.

Graduates who receive assistance through LRAPs get an average of $610 per quarter in loan repayment assistance.

Plus, college and university partners who offer LRAPs to education majors generate an average 5X return on their investment.

LRAPs are a win-win for students and institutions.

Want to learn more about how to empower future educators with powerful loan protection that creates access and drives enrollment? Read more here.